In this blog post I will be investigating online banks and will be comparing two of them. The two banks I will compare are Santander and HSBC.

Online banking services are an extension of the automated branch systems that banks brought in from the 1970s to the 1990s. They use computerised systems to allow customers to access and manage their own accounts using an internet connection., rather than having a bank clerk do it. The major piece of technology which allowed people to do this was Internet access with encrypted security technology. For online banking it is vital that only the customer and the authorised bank staff can access the customers account and no none else is able to, or people will easily be able to steal money from other people. Through online banking, banks can offer more to their customers such as finding their balance and making a payment at any time of day or night.

Online banking targets people who have busy lives and may not have enough time to go to the bank every time they need to withdraw money. An example of people like this are single mums. This is because they will need to work and look after their children and will not have enough time to go to the bank everyday to take money out, and if they can take the money out at home it will be much easier for them.

Now I will discuss how the two banks I'm investigating do online banking and I will discuss which one has the most advantages and is better. Both the banks HSBC and Santander provide an online banking service to their customers.

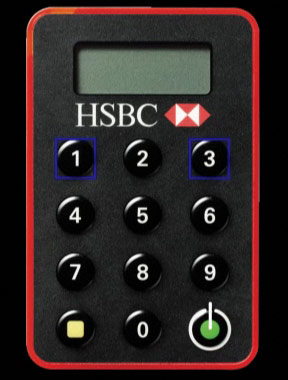

First I will discuss HSBC's online banking service. HSBC provide their customers with a "secure key". This is a key where the customers will type their pin number into it and it generates a secret code which you put into the website, and this will lead to the customers online bank account. This is an easy and safe method of accessing an online bank account and is useful to everyone who has a busy lifestyle or does not have much time in the day. This card is also small and portable. This helps people because it allows them to take it wherever they need to and if they ever need to see their bank details they can. All of he information in this paragraph is from http://www.hsbc.co.uk/1/2/customer-support/online-banking-security/secure-key.

First I will discuss HSBC's online banking service. HSBC provide their customers with a "secure key". This is a key where the customers will type their pin number into it and it generates a secret code which you put into the website, and this will lead to the customers online bank account. This is an easy and safe method of accessing an online bank account and is useful to everyone who has a busy lifestyle or does not have much time in the day. This card is also small and portable. This helps people because it allows them to take it wherever they need to and if they ever need to see their bank details they can. All of he information in this paragraph is from http://www.hsbc.co.uk/1/2/customer-support/online-banking-security/secure-key.

However, reviews from http://www.reviewcentre.com/reviews3218.html#Reviews show that the bank is poor. The reviews from this website are from past customers and the overall rating was 1.9/5 (just under 2 stars). This is a very poor rating and quotes from the website are that the bank is "poor" and "everything take forever".

Now I will discuss Santander's online banking service. The Santander website says that they are committed and will protect your online savings. The website says that the way they protect peoples online bank account is they use two areas: freely accessible and secure. In the freely accessible areas anyone can view it and this area contains all the general information about Santander's products and services. All of the customers personal details are kept in the secure areas. In these areas people have to enter a personal password and security number to access the information in there. The secure areas is where people will access all of there bank account details and where they can access there bank. All the information in this paragraph is from http://www.santander.co.uk/csgs/Satellite?appID=abbey.internet.Abbeycom&c=Page&canal=CABBEYCOM&cid=1210606981284&empr=Abbeycom&leng=en_GB&pagename=Abbeycom%2FPage%2FWC_ACOM_TemplateA2.

Now I will discuss Santander's online banking service. The Santander website says that they are committed and will protect your online savings. The website says that the way they protect peoples online bank account is they use two areas: freely accessible and secure. In the freely accessible areas anyone can view it and this area contains all the general information about Santander's products and services. All of the customers personal details are kept in the secure areas. In these areas people have to enter a personal password and security number to access the information in there. The secure areas is where people will access all of there bank account details and where they can access there bank. All the information in this paragraph is from http://www.santander.co.uk/csgs/Satellite?appID=abbey.internet.Abbeycom&c=Page&canal=CABBEYCOM&cid=1210606981284&empr=Abbeycom&leng=en_GB&pagename=Abbeycom%2FPage%2FWC_ACOM_TemplateA2.

Reviews from http://www.reviewcentre.com/reviews190544.html show that this bank is also poor. Santander got a rating of 1.2/5 (just over 1 star). This is a terrible rating and some quotes from the website say "worst bank" and "rubbish".

Overall, both the banks I have investigated say they are great on the websites, but then reviewing websites say neither banks are good. However, I believe that HSBC is the better of the two banks and I would recommend this one. This is mainly because of the online banking service it provides. As customers use a key card, it is easily accessible and very quick. It is also safe.

Independent Banks in the UK:

The five independent banks in the UK are: HSBC, Royal Bank of Scotland, Lloyds Banking, Barclays and Standard Chartered.

No comments:

Post a Comment